|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance for Your Cat: A Complete Beginner’s GuideIn the heart of every cat owner lies an unspoken bond with their feline companion, a relationship built on warmth, affection, and mutual respect. As these enigmatic creatures purr their way into our lives, the question of their well-being becomes paramount, leading many to consider the merits of insuring their beloved pet. While the concept of cat insurance may seem novel or even superfluous to some, a deeper dive reveals its potential as a vital component of responsible pet ownership. Why Insure Your Cat? At first glance, the idea of insurance for a pet might seem unnecessary, especially when cats are often perceived as low-maintenance animals. However, just like humans, cats can encounter unexpected health issues or accidents that may result in substantial veterinary bills. The financial burden of these costs can be alleviated significantly with the right insurance policy, allowing you to focus on the care and recovery of your feline friend without the added stress of financial strain. Understanding the Types of Coverage As you embark on the journey of finding the perfect insurance for your cat, it's essential to understand the various types of coverage available. Generally, policies can be categorized into three main types: accident-only, time-limited, and lifetime coverage. Accident-only policies, as the name suggests, cover injuries resulting from accidents but do not extend to illnesses. This type of coverage is often the most affordable option. Time-limited policies provide coverage for both accidents and illnesses, but only for a specified period, typically 12 months. On the other hand, lifetime coverage offers the most comprehensive protection, covering accidents and illnesses throughout your cat's life, albeit usually at a higher premium. Factors to Consider When Choosing a Policy Selecting the right policy involves weighing several factors, such as your cat's age, breed, and existing health conditions. Older cats or those with pre-existing conditions may face higher premiums or exclusions. Additionally, some breeds are predisposed to specific health issues, which might influence the cost and type of coverage needed. Therefore, thorough research and comparison of different policies and providers are crucial steps in making an informed decision. The Emotional and Financial Benefits Beyond the tangible financial relief that insurance can provide, there's an emotional peace of mind that comes with knowing you're prepared for the unexpected. In a world where veterinary advancements continue to evolve, having insurance can also enable you to opt for the best treatments available, rather than being constrained by cost considerations. Final Thoughts In conclusion, while the initial thought of insuring your cat might seem daunting or unnecessary, the reality is that it offers both practical and emotional advantages. By investing in a policy that suits your needs and circumstances, you ensure that your feline companion receives the best possible care, allowing you to cherish the moments spent together without worry. To further assist in understanding this topic, let's delve into some frequently asked questions:

https://www.petco.com/shop/en/petcostore/insurance

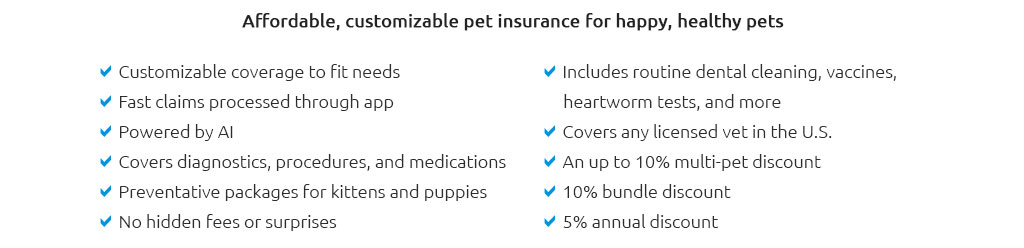

Two cats on our most popular plan would cost about $42/month. Electing coverage for four or more pets will increase your discount to 10%. Get a quote today. https://www.metlifepetinsurance.com/cat-insurance/

With plans starting at $7 per month, cat insurance reimburses you for covered expenses on your pet's health care, helping you save money and keep kitties ... https://www.geico.com/pet-insurance/

Pet insurance is a specialized health insurance for your beloved pets. Get affordable care for your pets by contacting GEICO today. Pet health insurance ...

|